Offshore Wealth Management Solutions: Crafting Your Financial Heritage Tactically

Structure a Solid Financial Future: Recognizing Offshore Wealth Management

Building a Solid Financial Future: Comprehending Offshore Riches Administration

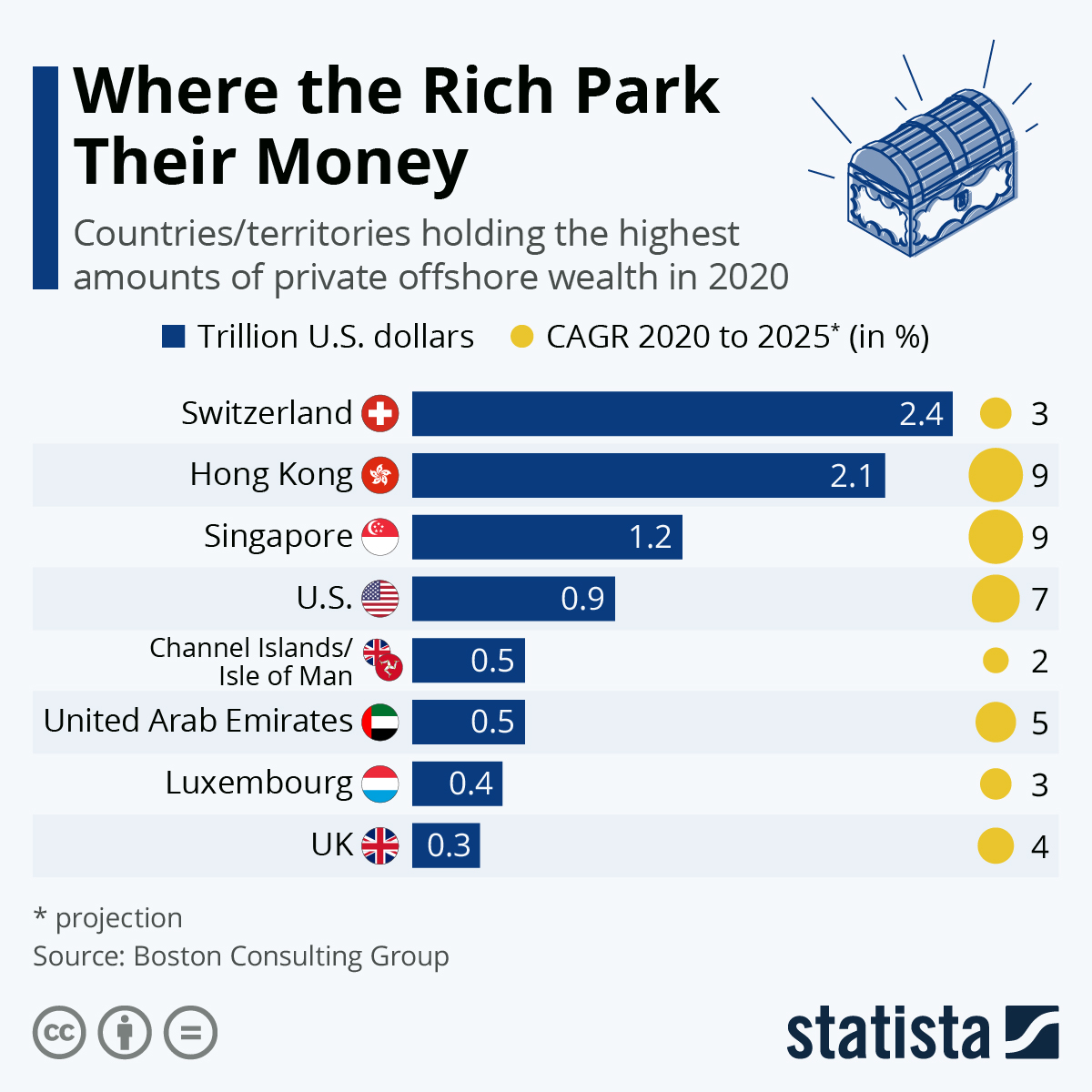

In today's globalized economy, offshore riches administration has ended up being an increasingly prominent technique for individuals and services aiming to secure their financial future. Navigating the complexities of offshore jurisdictions and locating the appropriate carrier can be a difficult task. This comprehensive overview intends to demystify overseas riches administration and supply important insights right into the vital variables to take into consideration. From comprehending the benefits of overseas riches administration to unmasking usual false impressions, this source will certainly gear up readers with the expertise needed to make educated decisions. By checking out why offshore wealth management is a viable alternative and exactly how to pick the ideal company, businesses and people can take proactive actions towards constructing a solid economic future.

Why Pick Offshore Wealth Administration

Offshore riches monitoring provides a range of benefits that make it an eye-catching option for individuals looking to safeguard and expand their wide range. Overseas riches monitoring can supply people higher personal privacy and discretion, as numerous offshore territories have stringent laws in location to secure the identity and monetary information of their customers. Generally, overseas wide range administration provides individuals a comprehensive suite of benefits that can assist them protect and enhance their riches.

Comprehending Offshore Jurisdictions

Offshore territories give a variety of legal and financial advantages for individuals seeking to handle their wide range effectively - offshore wealth management. These jurisdictions are normally situated in countries or territories that offer positive tax laws, privacy defense, and possession security. Recognizing overseas territories is essential for people that want to check out the advantages of offshore wealth management

Among the key benefits of offshore jurisdictions is their positive tax environment. Many offshore jurisdictions have little to no tax obligations on personal income, resources gains, inheritance, or riches. This enables people to legitimately reduce their tax responsibilities and maximize their wide range build-up.

Moreover, overseas jurisdictions provide robust possession defense measures. These jurisdictions have laws that secure possessions from lenders, legal actions, and various other legal cases. This can be especially advantageous for individuals looking for to secure their wealth from possible risks and uncertainties.

It is necessary to keep in mind that while overseas territories provide numerous advantages, it is critical to abide by all pertinent laws and regulations. Participating in prohibited or unethical tasks can have serious effects. As a result, individuals must seek advice from skilled specialists who focus on overseas wide range management to guarantee compliance and make the most of the benefits of offshore territories.

Secret Benefits of Offshore Wealth Monitoring

One of the substantial benefits of making use of offshore riches monitoring is the capability to maximize monetary development and stability. Offshore wide range administration supplies people with access to a broad array of financial investment chances that might not be offered in their home country.

One more trick benefit of overseas riches monitoring is the improved privacy and property protection it gives. By positioning assets in overseas jurisdictions, people can secure their wide range from possible creditors, claims, and various other legal dangers.

Additionally, overseas riches administration permits individuals to benefit from tax preparation approaches and minimize their tax obligation obligations. Offshore jurisdictions typically provide desirable tax obligation routines, such as reduced or absolutely no tax rates on funding gains, rewards, and inheritance. By structuring their assets and investments in a tax-efficient fashion, Going Here individuals can legally minimize their tax responsibilities and keep a larger portion of their wealth.

Elements to Consider When Choosing an Offshore Wide Range Management Provider

When selecting an overseas riches monitoring service provider, weblink it is important to take into consideration a number of vital elements. In addition, it is essential to examine the service provider's expertise and understanding in taking care of offshore financial investments.

An additional element to take into consideration is the range of services used by the service provider. Offshore riches administration involves numerous facets such as tax preparation, property security, and estate preparation. Ensure that the supplier supplies an extensive suite of solutions that line up with your economic objectives and objectives.

Additionally, it is vital to evaluate the service provider's ease of access and interaction networks. Offshore wide range management may require constant communication and updates. Therefore, it is very important to select a company that is easily obtainable and receptive to your needs.

Lastly, take into consideration the service provider's charge framework and rates. Offshore wide range monitoring services can differ dramatically in terms of price. It is necessary to recognize the cost structure and guarantee that it straightens with your spending plan and assumptions.

Typical False Impressions Regarding Offshore Wide Range Management

In reality, offshore wide range monitoring is accessible to a wide range of people that want to expand their assets and secure their wide range. While there have actually been situations of misuse and prohibited Discover More Here tasks associated with offshore accounts, it is essential to note that overseas wide range management itself is a legal and legit economic technique. Recognizing these false impressions can help individuals make notified choices concerning overseas wide range management and its potential benefits for their financial future.

Final Thought

In final thought, overseas wealth administration provides numerous benefits such as possession protection, tax optimization, and boosted personal privacy. By recognizing overseas jurisdictions and selecting a respectable carrier, people can develop a solid economic future. It is vital to consider elements such as regulatory framework, online reputation, and knowledge when choosing a wide range monitoring company. Despite common mistaken beliefs, offshore wealth management can be a valuable device for individuals aiming to improve their monetary techniques and attain their long-lasting goals.

Offshore riches management can use individuals higher personal privacy and discretion, as lots of overseas jurisdictions have stringent regulations in place to secure the identity and monetary information of their customers. Recognizing overseas territories is crucial for individuals that desire to explore the advantages of overseas riches management.

Individuals need to consult with seasoned experts that specialize in overseas wide range administration to make certain compliance and optimize the benefits of overseas jurisdictions.

In fact, overseas riches monitoring is accessible to a broad range of people that desire to diversify their properties and secure their wide range. While there have been situations of abuse and unlawful activities associated with overseas accounts, it is essential to note that offshore wealth administration itself is a legal and genuine monetary technique.